As of April 6th 2021, businesses in the UK must submit their P11Ds digitally. P11Ds are documents that are supplied to HMRC each year to declare any expenses or benefits that have been provided to employees or directors. These forms have previously been sent to HMRC via post, but with the introduction of new legislation, employers must now submit these forms digitally.

This change is an important one for businesses across the UK, as it will help to improve the accuracy and efficiency of the filing process. It also ensures that businesses are compliant with the latest legal requirements.

P11Ds

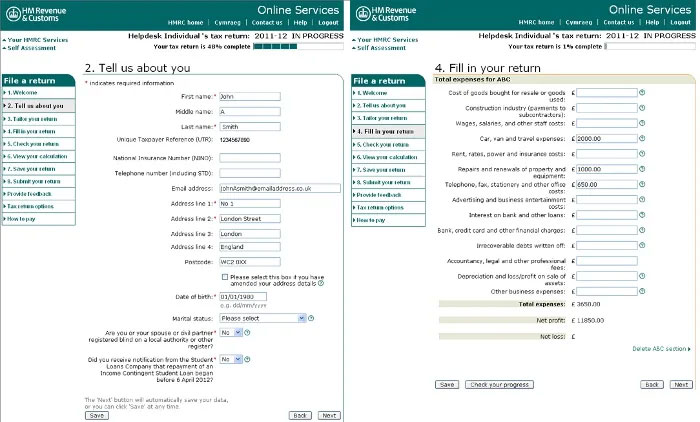

The requirements for filing P11Ds digitally are relatively straightforward. Firstly, you must register for a Government Gateway account, which can be done on the HMRC website. You must then provide your Unique Taxpayer Reference (UTR) to confirm your identity. Once you have registered, you can then submit your P11D form online.

This can be done using either HMRC’s Basic PAYE Tools software or commercial software such as IRIS or Sage. These software packages are designed to simplify the filing process and make it easier to submit P11Ds digitally.

The benefits of filing P11Ds digitally are numerous. Firstly, it reduces the amount of paperwork required, which can save businesses time and money. It also ensures that the forms are submitted quickly and accurately, reducing the chances of errors. Additionally, it provides businesses with an audit trail, allowing them to easily track and view their filing history.

Conclusion:

In summary, businesses in the UK must now submit their P11Ds digitally. This change is an important one, as it helps to ensure businesses are compliant with the latest legal requirements. It also simplifies the filing process and provides businesses with an audit trail. We recommend that businesses ensure they are aware of the new digital filing requirements and take the necessary steps to ensure they are compliant. This includes registering for a Government Gateway account and using suitable software to submit their P11Ds. Doing so will help to ensure the process is efficient and accurate.

Skip to content

Skip to content