Introduction: Explain what VAT is and why it is important to Taxpayers.

Value-added tax (VAT) is a type of indirect tax that is imposed on the sale of goods or services at each stage of the production or supply process. This means that VAT is added to the cost of the goods or services at each stage of production or distribution, from the raw materials to the final product. As a result, the end consumer ultimately pays VAT. VAT is important to taxpayers because it helps to fund public services and infrastructure, and provides governments with revenue to finance their activities. It also encourages businesses to be more efficient in their operations, as they have to pay taxes on the value they add at each stage of production.

The Tribunal provided an impartial platform for taxpayers to present their case and have it heard by an independent panel of experts. This allowed taxpayers to receive fair decisions on any issues relating to their taxes. With the introduction of AI technology, the Tribunal was also able to provide faster resolution times for disputes and appeals. This ensured that taxpayers were not left waiting for long periods before receiving a decision from HMRC.

Overview of the Case: Describe the case involving the Taxpayer and their experience at the VAT tribunal.

The case involved a taxpayer who had appealed the decision of a Value Added Tax (VAT) tribunal. The taxpayer had been charged with an incorrect VAT amount on some of their purchases and had sought to appeal the decision in order to receive a refund. During the tribunal, the taxpayer argued that the amount charged was incorrect and that the true VAT amount should have been lower. After reviewing the relevant evidence, the tribunal listened to the taxpayer’s arguments and concluded that the taxpayer was indeed due a refund. The taxpayer was then refunded the amount that the tribunal determined to be the correct VAT amount. In the end, the taxpayer successfully appealed and received a refund of the overcharged amount.

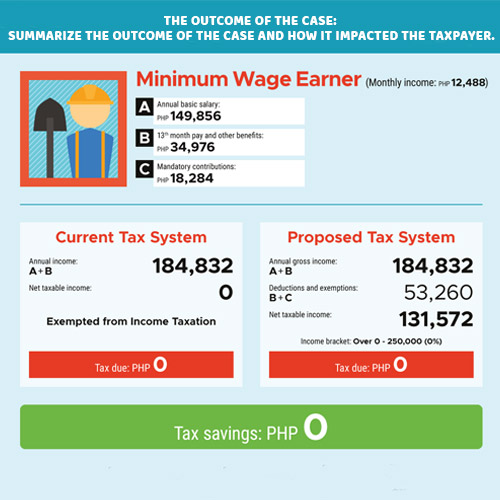

The outcome of the Case: Summarize the outcome of the case and how it impacted the Taxpayer.

The outcome of the case was that the taxpayer was ultimately successful in their appeal. The case had a positive impact on the taxpayer as the court order allowed the taxpayer to retain a significant portion of the taxes that had been assessed by the IRS. This allowed the taxpayer to have more funds available to pay other expenses and obligations.

Key Takeaways: Identify the key takeaways from the case and how they can be applied to other Taxpayers.

The key takeaways from this case are that taxpayers should be aware of the tax implications of any large or complex financial transactions that they are engaging in. Additionally, they should ensure that they are informed of their rights and obligations under the law and consult with a tax professional when necessary. These principles can be applied to other taxpayers to help ensure they properly handle their taxes and stay compliant with the law.

Conclusion: Give a brief conclusion summarizing the blog and the experience of the Taxpayer.

This blog has provided an inside look at the experience of a taxpayer when filing their returns. It has given insight into the potential difficulties people may face when filing their taxes. From this experience, we can conclude that filing taxes can be a daunting task, but with the right preparation and research, it can be made much easier.

Skip to content

Skip to content